BillsHappen.com is an innovative online platform designed to streamline the process of obtaining personal loans. It achieves this by connecting borrowers with an extensive network of licensed lenders, ready to offer financial assistance swiftly and efficiently.

Since its inception in 2018, BillsHappen has played a pivotal role in aiding over 250,000 individuals. The platform has been instrumental in providing financial solutions tailored to a wide array of needs. Whether it’s for covering unexpected expenses, funding auto repairs, paying off medical bills, or managing emergencies, BillsHappen has been there to help.

While BillsHappen itself is not a direct lender, it serves as a valuable intermediary. Its main role is to bridge the gap between borrowers in need and a diverse pool of lenders. This facilitates a smoother and more efficient loan connection process, ensuring that individuals can find the financial support they need without undue delay.

Is BillsHappen.com a scam?

No, BillsHappen is not a scam. It is a real website that can help you find personal loans. The platform has an extensive list of licensed and reputable lenders in their marketplace, ensuring borrowers can access personal loan services from trustworthy sources.

What can I use a BillsHappen personal loan for?

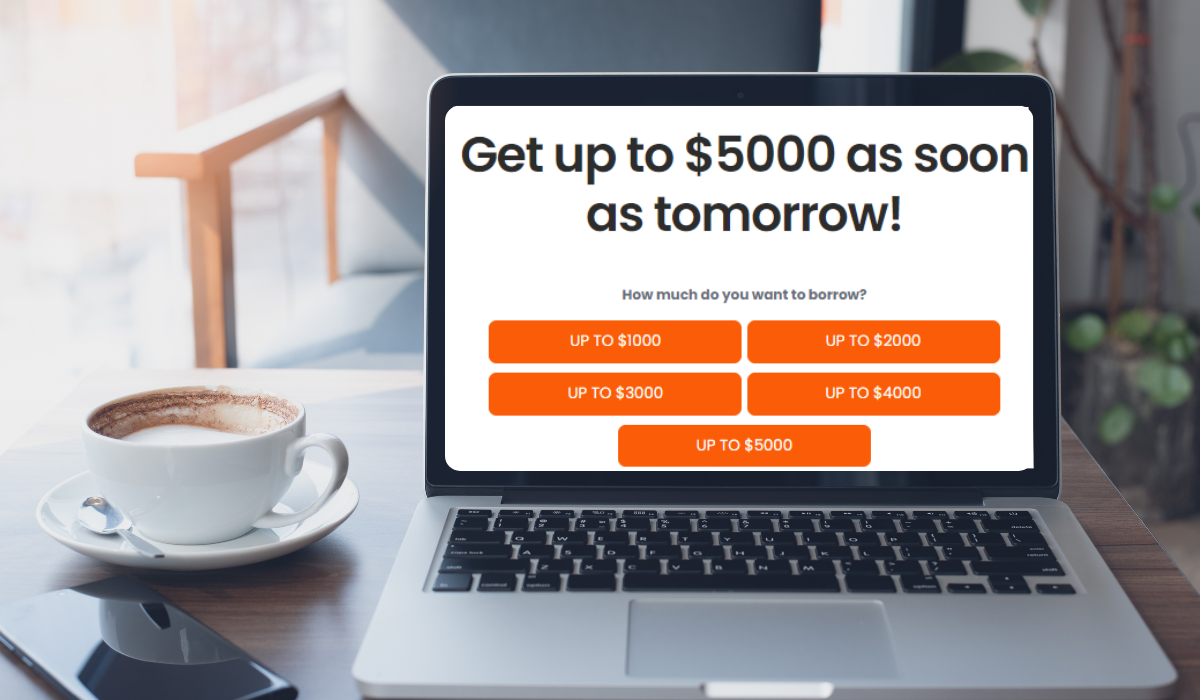

Personal loans from BillsHappen can be used for various purposes, including paying for unexpected household expenses, staying in the green until payday, catching up on unpaid bills, financing big purchases, and more. BillsHappen allows you to apply for loans ranging from $100 to $5000, depending on the lender’s evaluation.

Can I get approved for a loan with poor credit?

Yes, you could! BillsHappen works with lenders who understand that sometimes things happen to your credit score. The loan application process with BillsHappen only requires a soft inquiry on your credit to determine eligibility, which means that applying for a loan through BillsHappen won’t hurt your credit score.

How much does it cost to use BillsHappen?

BillsHappen is totally free to use! Some lenders do have fees associated with their loans, but the loan application process through BillsHappen doesn’t cost a dime.

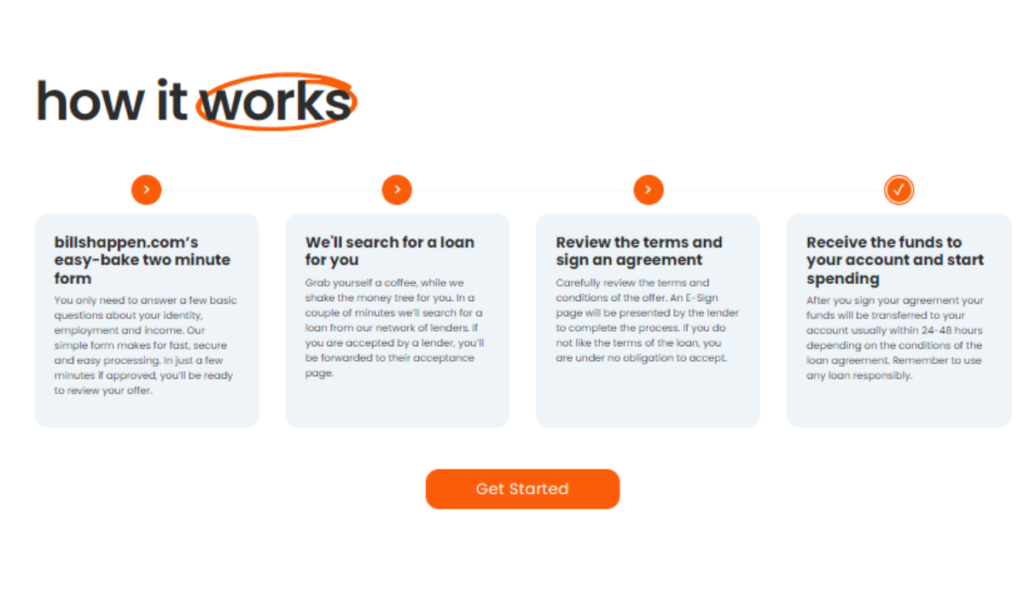

How does the loan process work?

The loan application process with BillsHappen is quick and easy. You fill out the online loan request form with the required information, such as your credit score, loan amount, personal information, and employment details. BillsHappen then connects you with lenders, and you choose the loan option that works for you. If you match with a lender, you could have access to your funds in as little as 24 hours.

How long does it take to get a loan with BillsHappen?

The loan application process through BillsHappen is quick and easy. It only takes a few minutes to complete the form. If you match with a lender, you could have access to your funds in as little as 24 hours

Key Features:

- Loan Range: Depending on the lender’s evaluation, borrowers can apply for personal loans ranging from $100 to $5000.

- Loan Purposes: Personal loans obtained through BillsHappen can be used for a variety of purposes, including debt consolidation, credit card payoffs, and covering unforeseen expenses.

- Quick Process: The loan application process is straightforward and can be completed online within minutes. If approved, borrowers may receive funds in as little as 24 hours.

- Security: BillsHappen emphasizes the security of personal information, using encryption technology to protect users’ data. They do not store personal information, ensuring privacy and confidentiality.

- Credit Flexibility: BillsHappen works with lenders who consider borrowers with poor credit histories, providing opportunities for individuals facing financial challenges.

Pros:

- Free Service: BillsHappen is free to use, offering a convenient way for borrowers to explore loan options without incurring additional costs.

- Extensive Lender Network: The platform collaborates with hundreds of licensed lenders, increasing the chances of borrowers finding a suitable loan offer.

- Speedy Funding: Borrowers may access funds quickly, making BillsHappen a viable option for those in urgent need of financial assistance.

- Transparent Process: BillsHappen provides clear information about the loan process, ensuring borrowers understand the terms and conditions before accepting any offers.

Cons:

- Loan Amount Variability: While borrowers can apply for loans up to $5000, the actual loan amount offered is subject to the lender’s assessment, leading to potential variability in loan approvals.

- Lack of Guarantee: Due to the nature of the platform as a connection service, there is no guarantee that borrowers will be matched with a lender or receive a specific loan amount.

Conclusion:

BillsHappen.com emerges as a steadfast platform for individuals in search of personal loans to meet a variety of financial needs, from emergency expenses to major purchases.

Its user-friendly interface simplifies the loan-seeking process, while an extensive network of licensed lenders increases the chances of finding a suitable loan offer. Moreover, BillsHappen’s unwavering commitment to data security ensures that personal information is protected, giving borrowers peace of mind.

Although BillsHappen.com does not directly offer lending services, it plays a pivotal role in connecting borrowers with reputable lenders. This service has been invaluable for many individuals in need of quick and accessible financial solutions, streamlining the process of obtaining a personal loan. Through a straightforward application process, borrowers can efficiently explore a wide range of loan options tailored to their specific circumstances.

Furthermore, BillsHappen.com distinguishes itself by offering resources and support designed to assist borrowers throughout the loan application process. This includes guidance on how to choose the best loan option and tips on managing finances responsibly.

As a result, BillsHappen.com is not just a platform for connecting with lenders; it is a comprehensive resource for individuals aiming to secure personal loans in a efficient and secure manner. In sum, BillsHappen.com stands out as a reputable and trustworthy platform for anyone looking to navigate the complexities of securing personal loans with ease and confidence.